Why do I need an enduring power of attorney as well as a will?

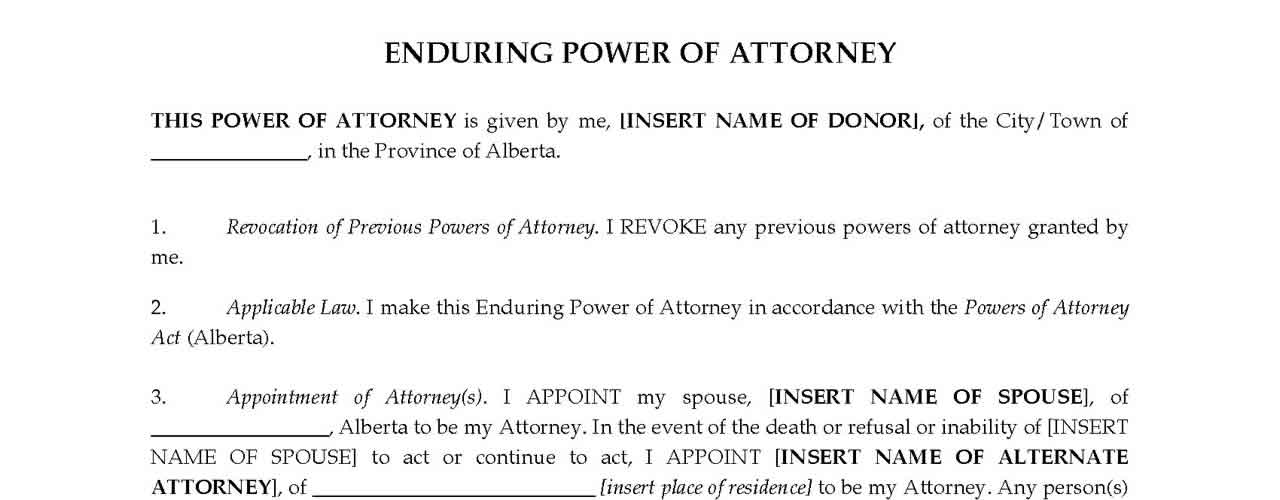

What is an enduring power of attorney?

An enduring power of attorney (EPOA) is a formal document which gives another person the authority to make personal and/or financial decisions on your behalf. The main difference between a EPOA and a General Power of Attorney is that an EPOA will “endure” and continue to be valid in the event you lose capacity.Why do I need one?

Olsen Lawyers recommends having an EPOA in addition to your will. This ensures someone you trust has the...Duty Concessions For Home/First Home Owners Explained

When buying property in Queensland you must pay stamp duty, which is calculated according to the value of the property. If you intend to use the property as your home or are acquiring the residence as your first home you may be eligible to claim a concession that reduces the amount of stamp duty you have to pay.

Am I eligible for a home concession?

You can claim a home concession if you intend to live in the property as your principal place...Executing Transfers Outside of Australia

When executing transfers outside of Australia or selling real property in Queensland (e.g. house, unit or land), you are required to execute a Form 1 – Transfer. The original form is then registered at the Titles Office of Queensland and officially signifies the change in ownership from you to the new owner. Because of the important nature of this form, there are stringent rules set out in the Land Title Practice Manual about executing the form in the correct way.

What are...

Transferring Property to your Partner

It is normal practice that spouses or de facto partners hold ownership in their property jointly. However, there are times, when you may need to consider holding the property in only one name. When: if real property (house, land, unit, etc.) is owned in joint names and you want it exclusively owned in one person’s name Why: there a numerous reasons, but some of the more common uses are – asset protection – where one partner is in a high risk career...

Foreign Investment In Residential Land – Are You Complying with the Legislative Requirements?

From 1 December 2015 the Commonwealth government of Australia introduced sweeping reform of the laws regarding foreign investment into land in Australia. The penalties for failure to comply with foreign investment laws are strict and accordingly it is important to understand your obligations prior to purchasing residential land in Queensland. The Rules Generally foreign persons can only purchase land in Queensland if the purchase is for a new build or vacant land on which a new building will be constructed. However, it...

Capital Gains Tax (CGT) Withholding

The Commonwealth government has introduced a new CGT (Capital Gains Tax) withholding regime targeted at ensuring foreign residents comply with their CGT obligations when they dispose of real property in Australia. However, in effect all vendors and purchasers of property in Australia (not just foreign residents) are affected by the new regime and must comply with the requirements of Australia Tax Office (ATO). The Regime The withholding regime applies to any contract for real property in Australia (worth at least $2million) and...